Isn’t it awful when you’re stressed about paying your bills because you’re struggling with overdue payments from your clients? There’s been many times, particularly in my earlier years, when I’d think if everyone would just pay on time I wouldn’t be losing sleep worrying about paying my own bills!

If you’re struggling with overdue payments, you’re definitely not alone. This week, Newsroom reported that “Small businesses are struggling to make ends meet as they wait for an estimated $7.4 billion in overdue payments.” (based on the latest Xero Small Business Insights). They went on to report that, “half of small businesses are owed at least $7,000 on any given day, with half of the overdue invoices at least 16 days past due on average.”

Which is why, we need to get better at debt recovery. No more sleepless nights!

I solved the sleepless nights in my business by delegating our debt recovery to Hazel. This way I’m not contacting clients I’ve built a relationship with to ask about the overdue payments. Sales and customer service is (and should be) kept separate to overdues. Plus, I’d rather do ironing for a week than ask for payment as it’s just not my zone of genius, whereas Hazel represents me professionally in a friendly manner and approaches overdue payments as a personal challenge. She gets the same buzz when an invoice is paid as I get after a successful discovery call.

Here’s how we approach overdue payments

Debt recovery isn’t rocket science; it’s a mixture of persistence and tenacity. Sometimes even courage! We have a procedure and we follow it, repeatedly. Whether we’re collecting for clients or for our business, the procedure remains the same.

1. The Statement

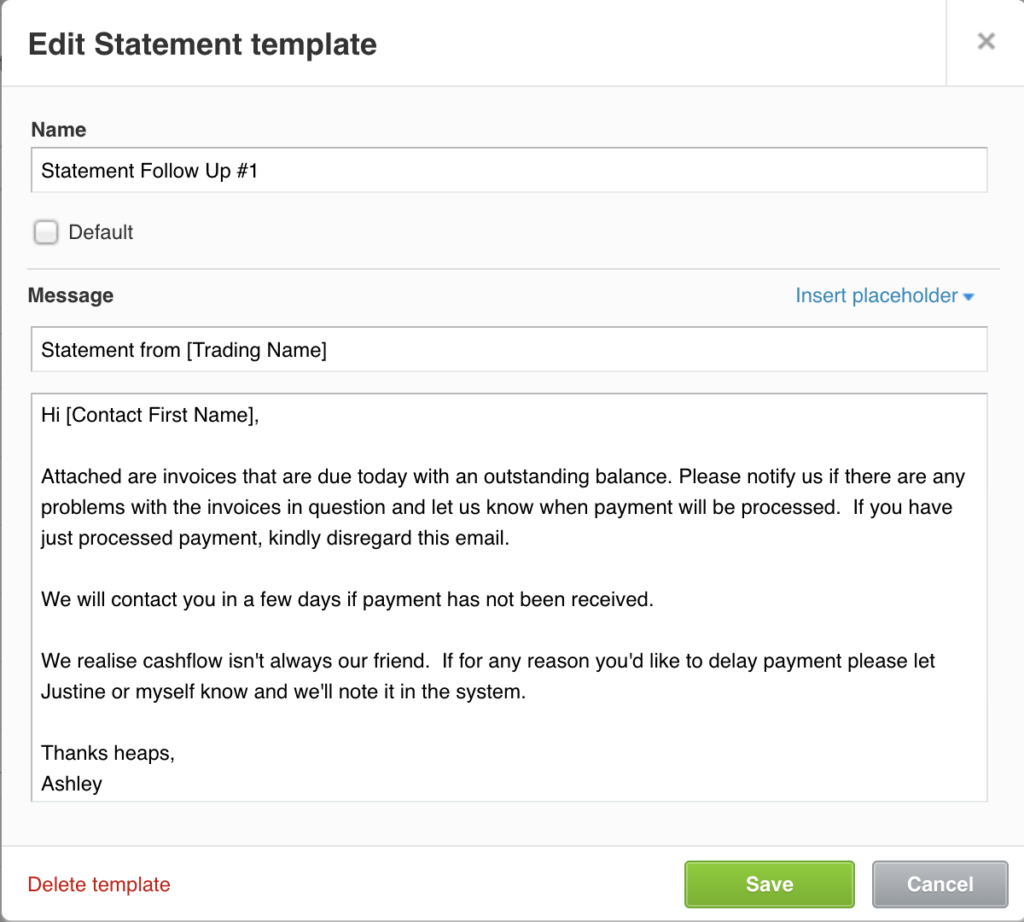

Sending regular statements minimises the risk of invoices being unpaid because they’ve gone astray. A statement will trigger a copy of an invoice or a query if a particular invoice is in dispute. We send our invoices out at the beginning of each month and statements are sent out 10 days later, so any copies can be sent through and processed before the 20th. Ashley, who does my bookkeeping, is responsible for our statements going out each month using this Xero template:

2. Email a Request for Payment

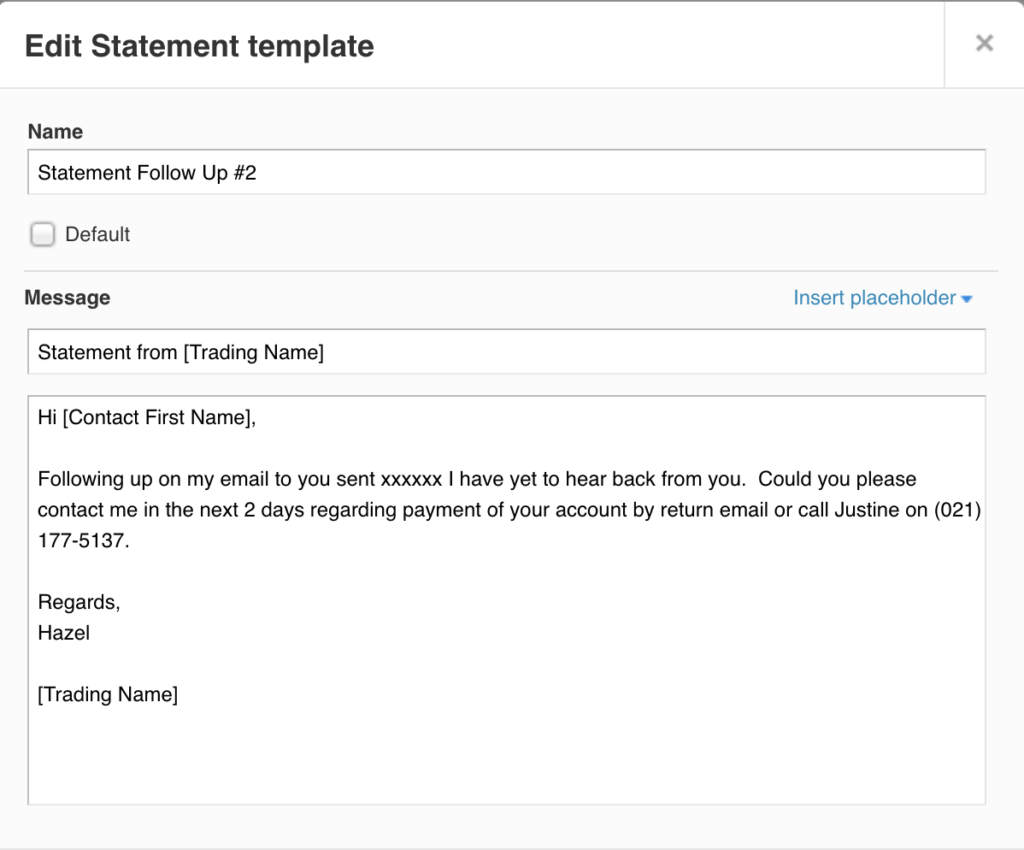

When an invoice falls overdue, email a friendly reminder. Here’s an example template we use:

3. Email a Second Request for Payment

At this stage, we hand any overdue accounts to Hazel via our project management system. She starts with a second email reminder or, depending on the amount or client, may go straight to #4 and phone the client. We will accompany this email with a short text message reminder.

4. Make the Phone Call

Chasing late payers by phone tends to get the best results. Once we have them on the line, it’s hard for them to ignore Hazel! We don’t say too much. They’re the ones who need to do the talking. We simply identify what’s overdue, ask when it will be paid, then wait in silence. Hazel doesn’t get off the phone until she has a firm expected payment date which she then notes in Xero for follow up.

5. Consistence and Tenacity

If the overdue amount isn’t paid as promised, Hazel’s back on the phone and will continue to phone until the debt is paid. If a payment plan has been agreed on, she’ll monitor it and a missed payment triggers another call. At this stage, it’s a case of making sure that when the client has money to pay overdue accounts with, we’re top of the list. And it’s a case of knowing Hazel won’t go away until that happens. Tenacity!

Ways to Minimise the Risk

Asking new clients to pay in advance until a relationship has been established is a good way to minimise your risk as a small business.

You can also set up a late payment fee in your payment terms which all new clients will need to sign. This can be good leverage if an amount becomes overdue; tell the customer they’re now in a late payment period and you’ll waiver the late payment fee if they pay immediately.

Some small businesses will put their customers on stop payment, particularly if they are often slow payers. This is a strategic decision you as the owner need to make, as it may mean the customer leaves. I suggest making this decision on a client by client basis, based on the circumstances for the overdue, your relationship with the client and the amount of business (i.e. risk) they do with your company.

![150 Tasks you can Delegate to a Virtual Assistant [free download]](https://yourva.co.nz/wp-content/uploads/2019/05/FREE-DOWNLOAD-1.png)

Having a healthy cash flow is paramount to your survival and success, so you have to learn how to tackle overdue invoices otherwise you put pressure on your own cash flow. But chasing for money is something many people naturally dread, particularly as most business owners want to stay friendly with their clients and not burn any bridges.

If it makes sense to outsource this part of your business, email me and I’ll get Hazel onto your following up on your overdues … all we need is an Excel sheet with the debtors information or access to your debtors ledger.

Click here to download your FREE guide on credit control tips!